The Top 3 Best 10 oz Silver Bars for Your Bullion Collection

Discover the smartest buys for your silver portfolio

By Jane Pardo | Updated June 23, 2023

For preppers and large investors, 10 oz silver bars are safe, reliable assets to hold for a long time.

Here are our top choices of silver bars, whether you’re a first-time investor interested in silver stacking or a seasoned investor adding stability to your portfolio.

Top 3 best 10 oz silver bars to buy

The best silver bars to collect for excellent returns are from well-established, trusted mints with a solid history and a stellar global reputation.

1. The Royal Canadian Mint’s 10 oz silver bar bullion

- Purity level: .9999

- Obverse: Purity, weight, serial number, and the Royal Canadian Mint seal

- Reverse: Royal Canadian Mint logo pattern

Boasting a rich history dating back to the 1900s, the Royal Canadian Mint is a world-renowned refiner reputable for consistently crafting a wide selection of specialized, top-quality coins and bullion products.

The Royal Canadian Mint’s 10 oz silver bar showcases fine details and a stunning bullion finish thanks to its exceptional fineness.

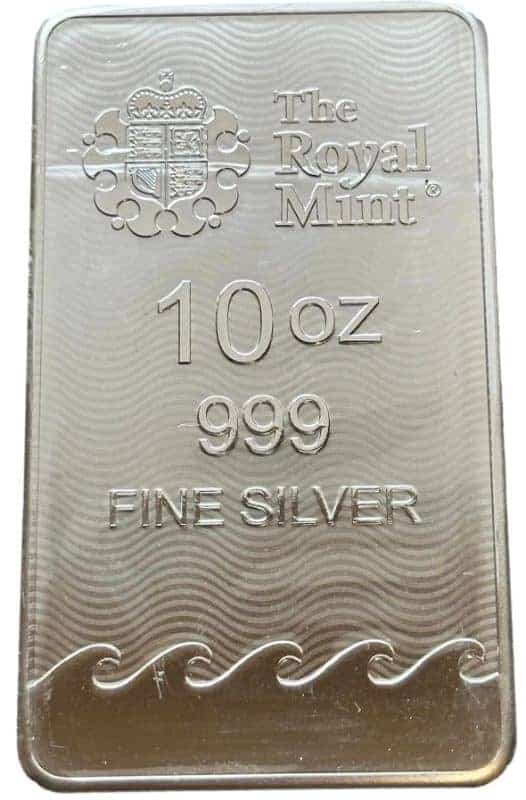

2. The Royal Mint Britannia silver 10 oz bar bullion

- Purity level: .999

- Obverse: Depicts Britannia (Britain’s female personification) holding her trident while gazing across the waves, representing the country’s unwavering fortitude and pride

- Reverse: Weight, purity, and The Royal Mint official seal and trademark against a backdrop of waves

The Royal Mint has provided outstanding British coinage for centuries, and it’s now the leading export mint globally. It’s the biggest and most advanced minting facility worldwide.

The Royal Mint Britannia 10 oz silver bar has a beautiful, elaborate design that adds to its aesthetic appeal, making it a stunning addition when collecting silver bullion.

3. Asahi Refining silver 10 oz bar bullion

- Purity level: .999 silver

- Obverse: Asahi logo and name, purity, and weight

- Reverse: Repeating Asahi Metals logo pattern

While Asahi Refining is a relatively new refinery in the global precious metals market, the company combines nearly two centuries of precious metals refinery experience and modern, cutting-edge techniques to create the best bullion products.

Asahi Refining’s 10 oz silver bar has clean-cut engravings and a substantial feel representing the mint’s refinery expertise.

Pros and cons of buying 10 oz silver bars

Silver bars are perfect for investors who want a balance between affordability and easy storage. Evaluate the following pros and cons of 10 oz silver bars before shopping around.

Benefits:

Drawbacks:

How to choose the best silver bars to buy

With the wide array of silver bars to choose from, new investors get confused when trying to decide which ones to buy. Here are critical factors to consider:

- Brand/assayer: The Royal Canadian Mint, Asahi Refining, the UK’s Royal Mint, Valcambi, and Credit Suisse are some of the world’s most respected brands. Choose a manufacturer with a stellar reputation to ensure excellent quality.

- Good Delivery-accredited refiner: A Good Delivery certification, provided by a London-based bullion market association, guarantees the trustworthiness of a refiner.

- Fineness: Choose silver bars with at least .999 purity if you intend to trade them on bullion exchanges.

- IRA precious metals investing: Know the do’s and don’ts by thoroughly reading the Internal Revenue Service’s rules and regulations when managing an individual retirement account (Such as rules about private storage)

- Assay packaging lets you verify that your silver bar is authentic and safeguards it from damage. A silver bar with no assay certificate will be hard to sell, as buyers would doubt its authenticity.

Final thoughts

With lower premiums over silver spot price, silver bars are undoubtedly excellent assets for long-term investment.

Prepare a well-thought-out plan for buying, storing, and safekeeping your silver bars before you place an order. When buying silver for your self-directed IRA, be aware of the proper process of storing bars with a non-bank trustee or an approved depository.

Now that you’re ready to take your next step, read our extensive guide on where to buy silver bars wholesale to get the best prices online.

Written by Jane Pardo

Jane Pardo is our senior gold & silver expert. Jane lends insight into precious metals investing, collecting, testing, and maintenance.

Trending posts under

As participant in an affiliate advertising program, we earn from qualifying purchases.