How Much is a Pound of Gold Worth? Gold Cost Per Lb

Gold Price Calculations and the Factors Influencing the Precious Metal’s Value

By Jane Pardo | Updated January 3, 2024

Did you know gold had a fixed price of $20.67 per troy ounce from 1834 until 1933 when the US remained on the gold standard? In 1934, the US devalued the dollar against gold, effectively increasing the price of gold to $35 per ounce.

Since then, the price of gold has considerably appreciated and produced significant returns through the years.

Today, many investors consider gold an outstanding store of value and an excellent asset if you want to diversify your investment portfolio or hedge against risk.

Keep reading to know the price of gold today and understand the factors affecting gold prices.

Price of gold per pound

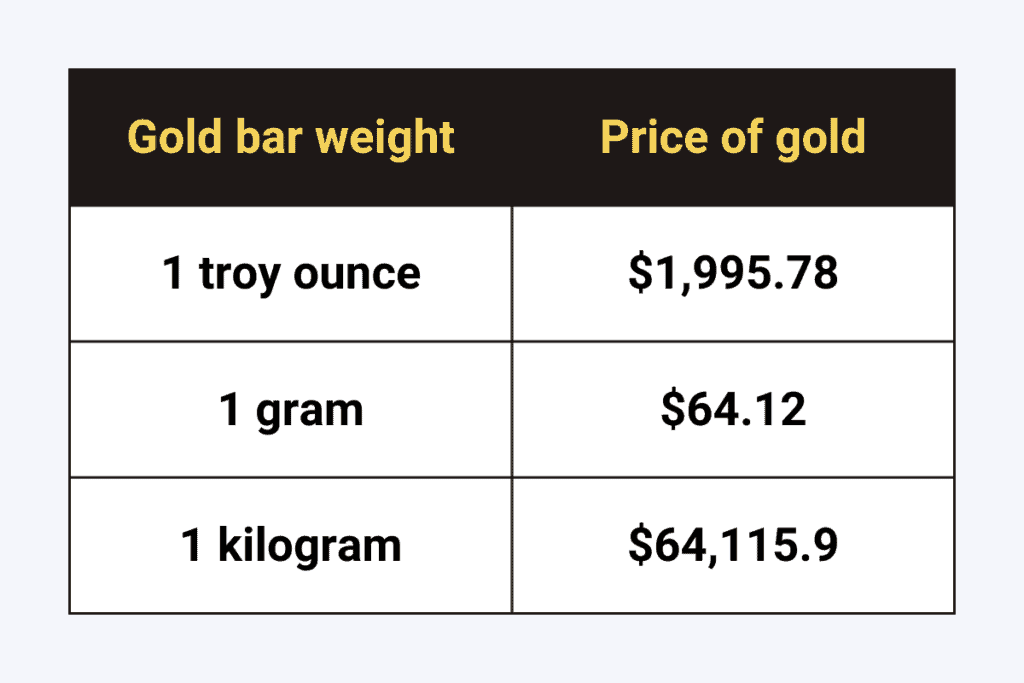

At the time of writing this article, the spot price of gold is $1,995.78 USD per troy ounce, $64.12 per gram, and $64,115.9 per kilogram.

The highest price of gold in 52 weeks is $2,040, whereas the lowest is $1,811.

| Gold bar weight | Price of gold |

|---|---|

| 1 troy ounce | $1,995.78 |

| 1 gram | $64.12 |

| 1 kilogram | $64,115.9 |

How much is a pound of gold worth?

Gold marketplaces generally buy and sell gold by the troy ounce. Smaller investors typically track gold prices per gram, whereas investors who buy gold in bulk monitor gold prices per ounce and kilo.

Here’s how you can determine the cost of gold per pound:

- First, convert 1 pound into troy ounces (1 pound is 14.58 troy ounces).

- Next, multiply the spot price of gold per troy ounce by the number.

The current gold price per pound can be calculated by multiplying 14.58 troy ounces (the equivalent of one pound) by the present gold spot price ($1,995.78), resulting in a total of $29,098.47 USD for one pound of gold.

This would also be the current 1 lb gold bar price, although gold bars are usually not measured by pounds.

Factors affecting gold price

The market value of gold is constantly changing, although it doesn’t fluctuate significantly. Various factors influence the price of gold, including:

- Supply and demand: The amount of gold currently available and the demand for it drive gold prices up and down. As the law of supply and demand suggests, prices increase when demand exceeds supply.

- Economic status: Gold is well-known as a safe haven investment overall. Savvy investors typically buy gold during times of financial turbulence, especially when the market is down, as the value and price of gold can increase.

- China and India: The rapid economic growth in these countries, combined with their cultural affinity for gold, creates a considerable demand that can influence gold prices on a global scale.

- Inflation: Rising inflation rates lead to a lower US dollar value. People then use gold as a possible hedge against inflation, as it’s not directly tied to the US dollar.

- Technological advancements: Industries such as electronics and medicine have opened new avenues for gold usage, contributing to its growing demand and potentially affecting its prices.

Central bank monetary policy, stock markets and bonds, and currency market activity all play a role in dictating gold prices.

Final thoughts

Investing in precious metals like gold and silver bullion is a time-tested strategy for wise investors as it allows you to spread risk across a well-balanced portfolio. Historically, the value of gold increased when other investment assets, such as real estate and bonds, performed poorly over long periods.

You can monitor the price of gold to evaluate gold market trends and get the best deal possible.

Live spot gold prices are readily accessible online, giving you valuable information in real-time to ease buying and selling decisions.

You may now be curious about the uses of this precious metal. Gold has numerous applications beyond just serving as a store of value. Learn about the fascinating and diverse ways gold is used daily by reading my article on the top 10 Uses of Gold.

Written by Jane Pardo

Jane Pardo is our senior gold & silver expert. Jane lends insight into precious metals investing, collecting, testing, and maintenance.

Trending posts under

As participant in an affiliate advertising program, we earn from qualifying purchases.